Many people will remember the COVID policy response as a nightmare involving: reduced access to medical treatment, businesses closures, disrupted schooling and fear generated by government brainwashing. After the event, it is always worth doing a Cui Bono (who benefits) exercise to identify who benefited, especially since the hopeless mainstream media has largely failed to do this.

Counterintuitively, the uber-wealthy owners of 0.1% of wealth in the United States, increased their net worth by a staggering USD 6.4 trillion over the 2022-2023 pandemic period. With their net worth growing from USD 12.1 trillion to USD 18.5 trillion, a pretty cool USD 20 million per head for approximately 300,000 people. This outcome is counterintuitive since the lockdowns temporarily wrecked the economy and had a significant negative impact on government debt, which ballooned due to staggering budget deficits. All things being equal, you would expect stock markets to move lower under these circumstances.

In the Alice-in-Wonderland world of extreme money printing though the stock market exploded and the benefit from this explosion accrued primarily to the uber-wealthy, who hold most of the financial assets. Regular folk without significant financial assets tended to get left with the rough end of the stick in the form of elevated inflation. We covered the link between money printing and financial asset values in a previous note (Where did the money go?), the chart below shows that money printing (red), moves in almost exactly the same way as the size of the wealth owned by the wealthiest 0.1% (blue). Both axes are in trillion (millions of millions).

You could credibly argue that the aim of monetary policy seems to be to prop up the value of the financial assets held by the uber-wealthy. Within the group of uber-wealthy, gains were not evenly distributed. The world’s second richest man, Jeff Bezos, made over USD 90 billion in paper gains over the first nine months of 2020 due to an increase in Amazon’s share price. A large part of this was thanks to lockdowns, which closed down the bricks and mortar competitors and diverted tens of billions of dollars to Amazon, whose sales growth doubled from around 20% to 40% towards the end of 2020.

Another group which seemed pleased with the lockdowns were the social engineers who had since the 1970s wanted to redesign society, including to reduce or even eliminate growth. The Chairman of the World Economic Forum, Klaus Schwab co-authored a book: COVID-19:The Great Reset. The book calls for significant parts of the lockdown response to be made permanent, the book’s cover makes clear that he wanted to leverage COVID for the purposes of introducing massive societal change.

They say that you should never let a good crisis go to waste, but what if rather than waiting for a good crisis, some interest groups created or simply exaggerated a crisis?

One thing that has become clear over the recent past is that the uber-wealthy have access to enormous lobbying power via their foundations, a large foundation can comfortably spend around USD 400 million a year on lobbying (philanthropy). As we discussed in our note on Green Money the resources of the oligarch foundations dwarf the funding available to regular political parties.

In addition to having access to foundations, the uber-wealthy have significant media reach in their own right. This is what several high profile business leaders said in 2020 about the coronavirus123:

As we now know the global infection fatality rate (IFR) was 0.03% for the under 60s4, this was not the existential threat that it was made out to be. The fact that COVID was not an existential threat and that the infamous Imperial model was significantly overstated was clear from March 2020, as soon as the Dimond Princess figures came in. Professor Levitt identified that the Imperial model was massively overstated (I was able to help him correct some small errors in the calculations5).

We can identify a small group of uber- wealthy who on an ex-post basis enjoyed rapid and large increases in wealth as lockdowns favoured their businesses, whilst disadvantaging competitors. Furthermore, the eye watering money printing significantly raised the value of pretty well all financial assets. Finally, a group of social engineers who wished to see a “Great Reset” involving reduced consumption also seemed well pleased with lockdowns, the WEF website carried gushing articles about the benefits of lockdowns.

It could be that the quotes above from Schwab, Soros and Gates were alarmist as they were made in the heat of the moment. I was always dubious about this explanation, Bill Gates’ quote was the earliest from February, but the others were later and after actual data was available. These individuals are very wealthy and must presumably be highly numerate and able to accurately assess risks. They would also have access to the best available researchers and sophisticated databases. It feels unlikely that they would get simple ratios significantly wrong, in my opinion.

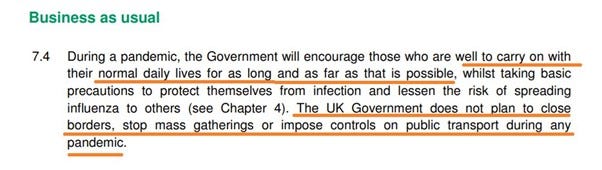

In any event, a credible case could be made to say that some vested interest groups wanted to see a terrible overreaction to COVID, provided that this was accompanied by enough money printing. It is worth remembering that the pre-existing pandemic response plans explicitly excluded lockdowns as a policy option6:

Keep reading with a 7-day free trial

Subscribe to Thinking Coalition’s Substack to keep reading this post and get 7 days of free access to the full post archives.